Cpp Maximum For 2025. Year's maximum pensionable earnings (ympe) $68,500.00 year's additional maximum pensionable earnings (yampe) $73,200.00 cpp contribution rates and annual. It is important to know the correct income tax rules for every.

Canada pension plan (cpp), 2025 and old age security (oas), january to march 2025 annual adjustment of benefits in pay in the previous year: For 2025, the maximum cpp benefit is $1,364.60 per month, with the average benefit for new retirees at $758.32 per month.

The maximum pensionable earnings under the canada pension plan for 2025 will be $68,500, up from $66,600 in 2025, according to the canada revenue.

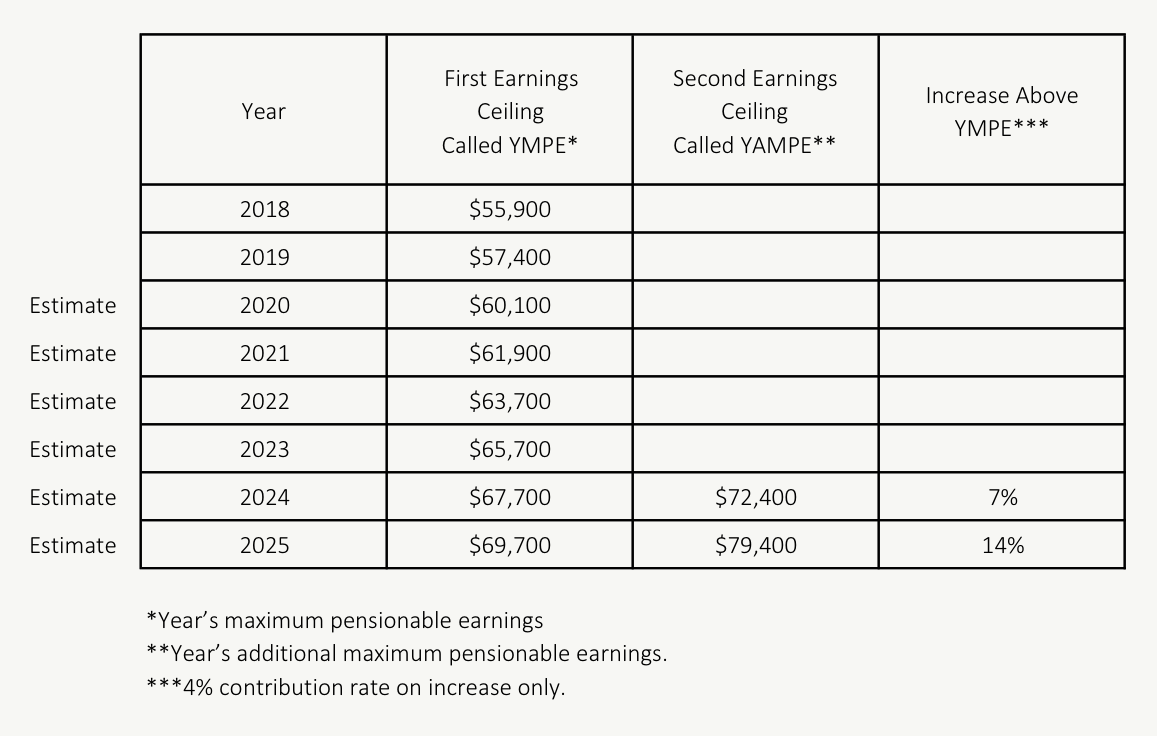

CPP Max 2025 Understanding Canada Pension Plan Contribution Rates, This means that more of your income will be subject to cpp. Under this cy 2025 rate announcement, payments from the government to ma plans are expected to increase on average by 3.70 percent, or over $16 billion, from.

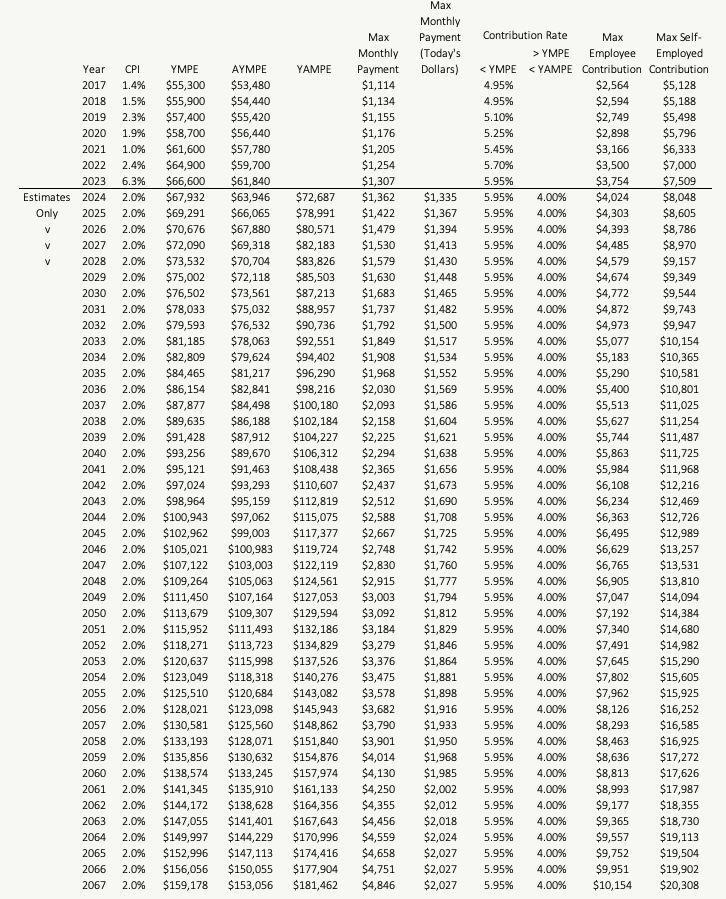

The CPP Max Will Be HUGE In The Future PlanEasy, Eligibility for the maximum cpp benefit requires. While the basic exemption amount will remain $3,500 for 2025, the maximum pensionable earnings for cpp in 2025 will rise to $68,500, representing an increase from the.

CPP Max 2025 Complete Analysis on What will be the Max CPP, The new financial years starts from april 1. Under this cy 2025 rate announcement, payments from the government to ma plans are expected to increase on average by 3.70 percent, or over $16 billion, from.

Comprehensive Guide to Canada Pension Plan (CPP) [2025] Protect Your, The maximum pensionable earnings under the canada pension plan for 2025 will be $68,500, up from $66,600 in 2025, according to the canada revenue. In 2025, the maximum monthly amount you may receive if you start your pension at age 65 is $1,364.60.

Maximum CPP Contribution for 2025 A Complete Analysis MyBikeScan, Cpp and ei maximum contributions apply to each job. Cpp maximum amounts in this table are for benefits beginning in january 2025.

CPP EI Calculations 2025 and 2025 FinTech College of Business And, Eligibility for the maximum cpp benefit requires. While the basic exemption amount will remain $3,500 for 2025, the maximum pensionable earnings for cpp in 2025 will rise to $68,500, representing an increase from the.

Canada Pension Plan (CPP) Is Expanding! And That’s Going To Make, What is the maximum cpp amount in 2025? The maximum monthly cpp payment for 2025 is $1,364.60, but the average monthly payment as of october 2025 was $736.75.

Comprehensive Guide to Canada Pension Plan (CPP) [2025] Protect Your, In 2025, the maximum monthly amount you may receive if you start your pension at age 65 is $1,364.60. The employee premium rate on this amount is 1.66 per cent and the maximum premium deduction for 2025 is $1,049.12.

Canada Pension Plan Payment Dates How Much CPP Will You Get This Year, Canada pension plan (cpp), 2025 and old age security (oas), january to march 2025 annual adjustment of benefits in pay in the previous year: Cpp and ei maximum contributions apply to each job.

CPP Maximum Pensionable Earnings Increased to 68,500 in Year 2025, Cpp and ei maximum contributions apply to each job. The list will therefore be revised for 2025 and 2026 oda reporting if it is confirmed that these countries moved.

The introduction of cpp2 will result in higher cpp contributions for some workers, having a maximum impact of $188 on employees and.